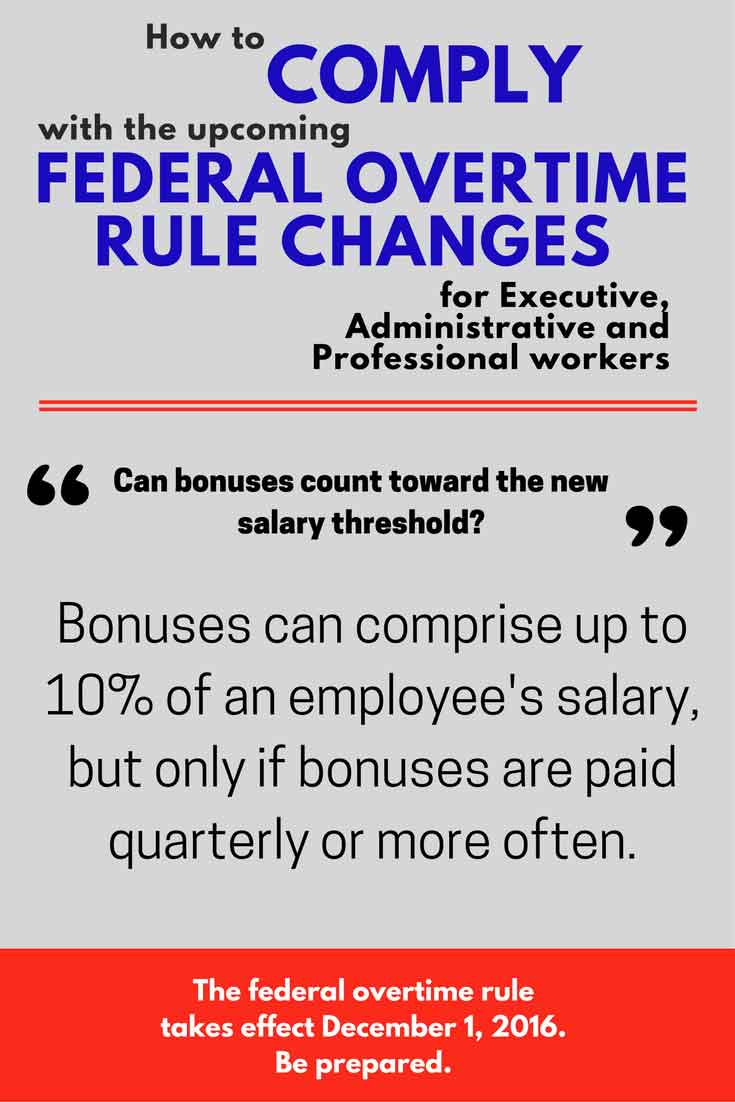

| Federal overtime rule: bonuses may account for 10% of salary |

|

| Tuesday, October 11, 2016 07:00 AM |

|

The new salary minimum required for an employee to be exempt from overtime is an increase of more than 50% over the previous salary threshold. Employers are no doubt looking for ways to meet this new minimum without doubling their payroll costs. Some employers may look to bonuses as a new way of helping to reach that requirement. According to the provisions in the federal overtime rule changes, bonus pay can now satisfy up to 10% of the minimum salary level. Previously bonuses could not be counted toward salary at all. The bonus pay “must be nondiscretionary bonuses and incentive payments (including commissions),” according to the Department of Labor. In other words, standards must be established in advance for an employee to earn the bonus—reaching a sales goal, remaining with the company for a certain amount of time, etc. A bonus awarded at the employer’s discretion, such as a holiday bonus or an unannounced reward for achievements, may not be applied toward the standard salary level.

Read more in this issue of Colorado Green NOW: |

When the new federal overtime rules regarding white collar workers go into effect December 1, employers may have a lot of changes to make in their payroll. For the first time, employers may use bonus pay in calculating the salary of white collar workers. This new provision can help those who come close to meeting the minimum, but there are restrictions on how much and what kind of bonus pay can be counted.

When the new federal overtime rules regarding white collar workers go into effect December 1, employers may have a lot of changes to make in their payroll. For the first time, employers may use bonus pay in calculating the salary of white collar workers. This new provision can help those who come close to meeting the minimum, but there are restrictions on how much and what kind of bonus pay can be counted.